Level term is a type of term life insurance that covers a specific period of time typically 10, 20 or 30 years whereby the amount of premiums and death benefits do not change through out a term.

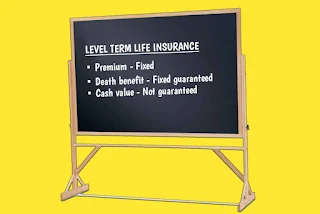

What is level term life insurance?

Level term life insurance is a type of term life insurance by which premiums and death benefits are fixed. This means, premiums and death benefits stay the same from the beginning to the end of a term. Level term is also known as level premium or level benefit life insurance.

Level term life insurance provide coverage for a certain period of time. Once a term expires, a policyholder can renew it or can let it lapse. If a policyholder dies within a coverage period, his family or beneficiaries receive death benefits from an insurer. In case a policyholder outlive the policy, premiums won't be returned.

In level term life insurance, the premiums increase once a policy is renewed. That is to say, the amount of premiums you will pay for a new term will be higher than of a previous term because of the increase of your age.

Features of level term life insurance

- Fixed premiums; In level term, premiums do not change. They remain the same from the begin to the end of a term.

- Fixed death benefit; Sum assured or death benefit do not change over time, the beneficiaries receive the fixed amount once a policyholder dies.

- Age & health based premiums; In most cases, premiums are set depending on insured's age and heath condition. Elders and unhealthy people pay higher than healthy and young people.

- Renewable; it can be renewed after the expiration date.

- No cash value; it only offers death benefits not cash value.

- Temporary; it provide coverage within a certain period (it has an end date).

Advantages of level term life insurance

1. It is cheap; Unlike permanent life insurance which is expensive, level term life insurance is cheap and affordable. This because, level term do not cover the entire life also does not have cash values.

2. Premiums and death benefits are fixed; In level term life insurance, premiums and death benefits do not change, thus they are predictable. This helps you to know the exact amount your beneficiaries receive once you pass away.

Disadvantages of level term

1. Since it covers a certain period of time, the policy may expire while you are still alive. And if you outlive a policy, the premiums will not be returned.

2. It has no cash values. Cash value is an amount that grows alongside your policy. Unlike permanent life insurance which provide both death benefit and cash value. Level term life insurance offers death benefits only.

3. Typically, premiums increases when you renew the policy, this is due to the increase of your age. Therefore, you can find yourself paying huge amount if you renew it many times.

Level term vs. Whole life insurance

Whole life insurance provides coverage for the entire life. It offers both death benefit and cash values. Whole life insurance is one of the types of permanent life insurance, other types are universal or adjustable, indexed universal and variable universal life insurance.

While,

Level term life insurance provide coverage for a specific period of time and offers death benefit without cash value. Level term is one of the types of term life insurance.

However, both level term and whole life insurance have fixed premiums and death benefits.

Level term vs. Decreasing term life insurance

In decreasing term, death benefits decrease as the age of an insured increases and is less expensive compared to traditional term life insurance. While

In level term death benefits do not change over time and is expensive compared to decreasing term.

Conclusion

Level term is suitable for those who are seeking for the policy that offers coverage with stable and predictable premiums and death benefit.